The US risks being thrown into recession by Donald Trump’s trade war as official figures showed the economy shrank during the first three months of the year.

America’s first contraction in three years was caused by a tidal wave of imports as businesses rushed to bring goods to the country’s shores before the President’s tariffs came into effect.

Stock markets tumbled on the steeper-than-expected drop as the scale of the slump sent investors into a fresh flight from US assets, while economists warned the drop in output shows the rising risk of a full-blown recession in America.

Richard Flynn at investment manager Charles Schwab said: “At this point, it’s difficult to imagine how a recession could be prevented, aside from substantial further backpedalling on tariff policy.”

“Recent shifts in US trade policy have dramatically increased the probability of a recession, so it seems very likely that this slowdown will be amplified in the coming months,” he said.

Even excluding the impact of higher imports, Oliver Allen at Pantheon Macroeconomics said there were “clear signs that the economy already was fundamentally slowing”.

“A period of stagnation now likely lies ahead if the current set of tariffs is maintained, with recession the most likely outcome if the additional reciprocal tariffs are imposed in full in July,” he said.

Growth was also held down by lower government spending, including on defence.

At the end of last year the US economy was the joint-fastest growing in the G7, and over 2024 as a whole it expanded by 2.8pc – far faster than second-placed Canada, where GDP increased by 1.5pc, or Britain which grew by 1.1pc.

It makes the sudden reversal in the economy all the more shocking.

Mr Trump blamed the crunch on his predecessor in the White House.

“This is Biden’s Stock Market, not Trump’s. I didn’t take over until January 20th. Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers,” the US President said in a post on his TruthSocial website.

“Our Country will boom, but we have to get rid of the Biden “Overhang.” This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!”

The Federal Reserve’s favoured measure of inflation fell in March, though much of the impact of tariffs on imported goods is yet to be felt, making it difficult for the central bank to simply cut interest rates to support the weakening economy.

Read the latest updates below.

10:26 PM BST

Wrapping up

Thanks for joining us on this live blog.

That’s all here for today, but you can read all the latest analysis and news on trade, the economy and business here .

09:52 PM BST

Microsoft boosted by cloud expansion

Microsoft has also delivered a strong set of results this evening in a further sign that tariffs and broader economic uncertainty are yet to hit consumer demand.

The tech giant reported a 13pc rise in third-quarter revenues to $70.1bn, while adjusted profit stood at $3.46 a share.

The strong trading was boosted by Microsoft’s Azure cloud computing service, which saw its revenues jump by a third. Shares rose around 6pc in after-hours trading.

09:44 PM BST

Meta beats estimates but warns of EU crackdown

Meta has beaten expectations for revenues in the first quarer in a sign the tech giant’s advertising business is so far weather Trump’s trade war.

The Facebook and Instagram owner posted sales of $42.3bn in the first three months of the year, ahead of analysts’ estimates of $41.4bn. Net profits jumped by 25pc to $16.6bn.

However, in comments that will raise eyebrows, Mark Zuckerberg’s company warned an EU crackdown on its advertising business will have a “significant impact” on its sales this year.

The comments come as Trump’s administration accuses Brussels of using its digital regulations as an “economic extortion” on US companies.

09:14 PM BST

Emirates: We remain vigilant over tariffs

Emirates has not seen any impact from Trump’s tariffs but remains cautious due to ongoing uncertainty, the airline’s chief commercial officer Adnan Kazim has said.

Speaking to Reuters in Dubai, Kazim said: “Things are looking quite positive. But it’s something, again, you cannot ignore. There are so many uncertainties out there that we need to watch and monitor.”

Emirates, the largest airline in the UAE and a key contributor to its economy, is the world’s biggest operator of Boeing 777 jets and one of the largest cargo carriers globally.

Asked whether Emirates would consider acquiring ordered aircraft that China may cancel in the wake of ongoing trade tensions, Kazim said each airline operates with specific design and business requirements.

“We cannot take other people’s or other companies’ aircraft for sure”, he added.

08:56 PM BST

Trump to make remarks on investing in America

Trump will shortly be delivering remarks on foreign investment in the US – one of the stated aims of his trade war – as the US President looks to set his economic agenda beyond his first 100 days in office.

08:53 PM BST

Trump: US kids may get ‘two dolls instead of 30’

Donald Trump has admitted his tariffs could result in fewer and costlier products in the US, saying American kids might “have two dolls instead of 30 dolls”.

The US President made the comments during a cabinet meeting, but insisted China will still suffer more from his trade war.

“You know, somebody said, ‘Oh, the shelves are going to be open,’” Trump said. “Well, maybe the children will have two dolls instead of 30 dolls. So maybe the two dolls will cost a couple bucks more than they would normally.”

But he said tariffs meant China was “having tremendous difficulty because their factories are not doing business,” adding that the US did not really need imports from the world’s dominant manufacturer.

08:08 PM BST

Canadian dollar rises as Trump says Carney wants to make a deal

The Canadian dollar has gained ground after Donald Trump said newly-elected Prime Minister Mark Carney wants to ink a trade deal.

Trump told reporters at a cabinet meeting that Carney plans to visit the White House within the next week.

“I think we’re going to have a great relationship. He called me up yesterday. He said ‘Let’s make a deal,’” Trump said.

The Canadian dollar strengthened against its US equivalent on Trump’s comments to trade as high as C$1.377.

Trump was asked about Carney’s remarks referring to US tariffs and threats to Canada’s sovereignty as a “betrayal.” The President replied that both Carney and his opponent in the election, Conservative Leader Pierre Poilievre, “hated Trump.”

“And it was the one who hated Trump, I think, the least that won. I actually think the Conservative hated me much more than the so-called Liberal,” Trump said, adding that Carney “couldn’t have been nicer” during their phone call on Tuesday.

“He’s a very nice gentleman and he’s going to come to the White House very shortly, within the next week or less.”

07:37 PM BST

Stay as long as you want, Trump tells Musk

Donald Trump has told Elon Musk he can stay working in the White House for as long as he wants, but understood the Tesla boss wants to get back to his business.

Musk last month said he will step down from his unofficial role as the head of the Trump administration’s “DOGE” cost-cutting department.

At a Cabinet meeting today, the President said: “The vast majority of the people in this country really respect and appreciate you.”

“And you know you’re invited to stay as long as you want,” Trump said, though added that Musk may want “to get back home to his cars.”

Tesla has suffered major brand damage as a result of Musk’s increasingly political role, with showrooms vandalised and calls for a boycott of the company across Europe.

07:11 PM BST

Ford to delay price rises amid tariff chaos

Ford has said it won’t increase the price of its vehicles until it sees how other car manufacturers respond to higher prices sparked by Donald Trump’s tariffs.

“You know half the industry in the US is imported and they have $5,000 to $10,000” in additional costs due to tariffs, Ford chief executive Jim Farley told reporters.

“Will they just absorb those? Will they pass them on to customers? That will be a big decision because a pricing decision is a competitive decision.”

Ford had previously planned to hike prices on its cars from May, with Trump’s tariffs expected to increase the cost of vehicles by thousands of dollars.

However, the President yesterday scaled back his tariffs on the automotive industry, saying he wanted companies to move production back to the US.

06:40 PM BST

Trump has already crashed the US economy. Worse may be yet to come

It’s official: America’s economy shrank in Donald Trump’s first months in office.

Tim Wallace delves into the numbers behind Trump’s first 100 days in office. Read his analysis here .

05:53 PM BST

Microsoft vows to protect Europe against Trump

Microsoft has vowed to protect its European operations against interference from Donald Trump as technology is increasingly used as a bargaining chip in trade negotiations .

Brad Smith, Microsoft ’s president, said the company was “prepared to go to court” to fight efforts by “any government anywhere in the world” in the event that access to its internet infrastructure is blocked in Europe.

Microsoft pointed out it had sued Barack Obama’s administration four times to protect the privacy of its European users, and the Trump White House in 2018 over the rights of immigrant employees.

Matthew Fieldhas the story – read more here

05:14 PM BST

Airbus: Tariffs add complexity amid supply troubles

Donald Trump’s tariffs have added “complexity” at a time when the world’s largest aircraft maker is already grappling with supply disruptions.

Guillaume Faury, Airbus chief executive, said: “We maintain the guidance that excludes tariffs which are adding complexity and remain uncertain in terms of implementation, scope and duration.

“We are closely monitoring and assessing the situation, but it is too early to quantify the impact today.”

Airbus was already battling a supply squeeze on parts ranging from engines to cabin interiors even before Trump sparked turmoil with sweeping global tariffs.

The company said it still aims to deliver about 820 commercial aircraft this year, though the target doesn’t include the fallout from tariffs and assumes “no additional disruptions to global trade or the world economy”.

Airbus said deliveries this year will be backloaded, “reflecting the specific supply chain challenges we are facing”.

For the first quarter, earnings before interest and tax stood at €624m (£530m) on revenue of €13.5bn.

04:38 PM BST

Trump should revise AI chip export rules, says Nvidia boss

The boss of Nvidia has urged Donald Trump to water down restrictions on exporting AI technology from the US to the rest of the world.

Jensen Huang told reporters: “We need to accelerate the diffusion of American AI technology around the world. The policies and encouragement from the administration really need to support that.”

Nvidia sells the leading AI chips for training AI models, including for ChatGPT maker OpenAI, but it’s been banned from selling its most advanced products to customers in China.

The Biden administration sketched out an additional policy for AI diffusion, or limiting the sale of AI technology to countries around the world based on three bands of qualification.

Huang said: “I’m not sure what the new diffusion rule is going to be, but whatever it turns out to be, it really has to recognise that the world has changed fundamentally since the previous diffusion rule was released.”

The Nvidia also warned about the rapid acceleration of China’s capabilities in AI chips – in particular those made by controversial tech firm Huawei.

“China is not behind,” he said. “Are they ahead of us? China is right behind us. We’re very, very close.”

04:07 PM BST

Trump relaxing car tariffs is ‘progress’ says Mexican president

Claudia Sheinbaum, the Mexican president, has welcomed her US counterpart’s softening of tariffs on carmakers, describing the move as a step forward in efforts to avert a trade war.

“It’s progress,” she told a news conference, adding that the new rules would give Mexico “an additional competitive advantage” owing to its free trade agreement with the US and Canada.

Donald Trump has watered down his tariffs on the car industry, signing an executive order during a visit to Michigan last night which scaled back the levies and offered credits to companies that make their vehicles in the US.

03:48 PM BST

GDP shrink is ‘stagflation warning shot’

The shrinking of the US economy could spell stagflation ahead, an economist has warned.

Ellen Zentner at Morgan Stanley Wealth Management said the weaker-than-expected report on the US economy had spooked financial markets as economists had forecasted modest growth.

The data has raised speculation over the worst-case scenario called stagflation, where the economy shrinks while inflation remains high. This poses a dual threat to the Federal Reserve as adjusting interest rates to satisfy one is likely to antagonise the other.

Ms Zentner said: “Even if today’s weak GDP may have partially reflected companies trying to get ahead of tariffs, it was still a stagflation warning shot over the bow of the economy.

“This type of data won’t soothe the markets, and it won’t make the Fed’s job any easier.”

The Dow Jones, S&P 500 and Nasdaq have fallen 1.1pc, 1.5pc and 1.8pc respectively.

03:32 PM BST

US inflation gauge falls in run-up to tariff tirade

The US Federal Reserve’s preferred measure of inflation measure cooled last month in the run up to Donald Trump’s “liberation day” tariffs.

The personal consumption expenditures (PCE) price index rose 2.3pc in the 12 months to March, the Commerce Department said, a decline from a revised 2.7pc rise in February.

This was slightly higher than economists’ forecasts for 2.2pc.

A widely-watched inflation measure stripping out volatile food and energy costs rose by 2.6 percent from a year ago – in line with expectations.

The slowdown in inflation is good news for the Fed as it seeks to keep both inflation and unemployment in check mainly by raising and lowering the level of its key interest rate, which currently sits at between 4.25pc and 4.5pc.

Traders have today priced in four expected interest rate cuts by the Fed before the end of the year.

03:26 PM BST

Navarro hails ‘best’ contraction in economy he has seen

President Trump’s economic advisor Peter Navarro said the decline in GDP was to be expected, adding it was the “best negative print I have ever seen in my life”.

“When you have this import surge that we’ve had to try to get in ahead of the tariffs, that’s dragging down our GDP growth by something like five per cent,” he told CNBC.

“I mean, it’s just like extraordinary. But that’s not going to be the case next quarter.”

Navarro said markets need to look “beneath the surface” following a sharp sell-off on Wall Street.

03:05 PM BST

Mexico outperforms US and avoids recession despite Trump tariffs

Mexico’s economy returned to growth in the first quarter of 2025, avoiding a recession despite uncertainty over Donald Trump’s sweeping tariffs, official data showed.

Gross domestic product (GDP) grew 0.2pc from the fourth quarter of 2024, when Latin America’s second-largest economy had contracted for the first time in three years, national statistics agency INEGI reported.

Year-on-year, GDP rose 0.6pc in the first quarter, it said in a preliminary estimate.

The new data means Mexico outperformed the US economy, which contracted in the first three months of the year.

The resilient performance eased fears of a recession, which is generally defined as two consecutive quarters of economic contraction - for now, at least.

The International Monetary Fund has predicted that Mexico’s economy will shrink by 0.3pc this year.

President Claudia Sheinbaum has said her outlook is more optimistic, because of the government’s efforts to boost the economy and attract foreign investment.

However JPMorgan analysts Steven Palacio and Gabriel Lozano said Mexico’s economy “is undoubtedly in a very weak state, particularly domestic demand”.

02:56 PM BST

Traders ramp up bets on US interest rate cuts

The Federal Reserve will cut interest rates four times this year, according to money markets, after the first contraction in the US economy in three years.

Traders have priced in a full percentage point reduction in interest rates before the end of 2025 after official figures showed a GDP contracted by 0.3pc in the first three months of the year.

Donald Trump has been urging the Federal Reserve to cut interest rates and criticised its chairman Jerome Powell for not lowering borrowing costs.

02:39 PM BST

Wall Street giants tumble at opening bell

Tesla, Apple and all of the other so-called Magnificent Seven group of stocks on Wall Street fell at the opening bell.

Meta and Microsoft fell 3.6pc and 1.9pc respectively as they prepare to report their first quarter results after markets close tonight.

02:33 PM BST

US stocks fall as American economy shrinks

Wall Street’s main stock indexes fell at the opening bell after Donald Trump’s trade war led to a worse than expected downturn in the US economy.

The Dow Jones Industrial Average fell 1pc at the open to 40,122.77 while the benchmark S&P 500 sank by 1.6pc to 5,474.58.

The tech-heavy Nasdaq Composite dropped by 2.2pc to 17,081.42.

02:25 PM BST

Stocks slump as Trump trade war pushes US into downturn

The FTSE 100 was at risk of breaking its longest run of gains in nine years after the official figures showed the US economy contracted during the first three months of 2024.

The UK’s blue-chip stock index fell as much as 0.3pc, putting it on track end a run of 12 consecutive daily increases.

The FTSE 100 has been on its longest positive streak since January 2017, although the index was still on track for a monthly decline of 1.3pc in the wake of President Trump’s tariff tirade.

European stocks were also lower after data showed the US economy shrank by 0.3pc during the first quarter.

The Cac 40 in Paris dropped as much as 0.3pc while the Dax in Frankfurt slumped as much as 0.5pc.

Neil Birrell, chief investment officer at Premier Miton, said: “Consumer spending was weak as well. None of that should be surprising, but it is still negative news and it’s difficult to think that the consumer is in a much better place today.

“The uncertainty around the outlook will be dominating consumers and businesses alike and the chances of the economy slipping into recession are rising.”

02:19 PM BST

Trump blames Biden for economic slump

Donald Trump blamed Joe Biden for “bad numbers” as official figures showed the US economy contracted for the first time in three years.

The US president said he had to deal with the “overhang” left by his predecessor, insisting the current malaise is “nothing to do with tariffs”.

02:14 PM BST

Trump trade policy ‘increased probability of recession’

Donald Trump’s tariff onslaught has increased the possibility of the US falling into recession, according to broker Charles Schwab UK.

Managing director Richard Flynn said: “Today’s figures show that the economy continued its downward trajectory at a faster rate than anticipated.

“Recent shifts in US trade policy have dramatically increased the probability of a recession, so it seems very likely that this slowdown will be amplified in the coming months.

“At this point, it’s difficult to imagine how a recession could be prevented, aside from substantial further backpedalling on tariff policy.

“We have recently seen President Trump and Federal Reserve Chairman Jerome Powell butt heads on how to address the issues the economy is facing.

“The President has demanded interest rate cuts, while Powell has taken a more hawkish stance, due to concerns about the impact of tariffs on inflation.

“With the labour market steady and uncertainty remaining high, it feels highly unlikely that the Fed will adjust policy in response to the slowdown in growth we have seen today.”

02:06 PM BST

Musk’s federal spending crackdown hits US economy

Elon Musk’s crackdown on federal spending was also a significant factor in the downturn in the US economy.

The savings made under his Department of Government Efficiency, known as Doge, send federal spending down by 5.1pc.

The key driver of the downturn was the sharp increase in imports before President Trump announced his “liberation day” tariffs.

The 41.3pc annualised surge in imports knocked nearly five percentage points off US GDP in the first three months of the year, pushing it into its first contraction since 2022.

However, economists expect this to reverse in the second quarter of the year.

Paul Ashworth, chief North America economist at Capital Economics, said: “The decline in first-quarter GDP was actually smaller than the 2pc contraction we were expecting following the big jump in goods imports in March reported yesterday.”

He added: “Overall, not as bad as feared, although some of the drop back in imports in the second quarter will now be partly offset by a slowing in inventory accumulation. We forecast a 2pc annualised rebound in second-quarter GDP.”

01:50 PM BST

Wall Street poised for slump as US economy shrinks

US stock indexes fell in premarket trading after the American economy contracted by more than expected in the first quarter of the year.

Gross domestic product (GDP) fell 0.3pc in the quarter, the US Bureau of Economic Analysis siad in its first estimate, compared with expectations for a 0.2pc contraction.

Separately, the ADP National Employment Report showed private payrolls rose by 62,000 in April, compared with estimates for an increase of 115,000.

In premarket trading, the Dow Jones Industrial Average was down 138 points, or 0.3pc, the S&P 500 was down 42.5 points, or 0.8pc, and the Nasdaq 100 E-minis was down 215 points, or 1.1pc.

01:46 PM BST

US economy shrinks for first time since 2022

The US economy contracted for the first time since 2022 amid “anxiety” about the impact of tariffs on businesses.

Imports were primary driver of the downturn in the US economy, shaving five percentage points off first-quarter growth, the most on record, according to the US Bureau of Economic Analysis.

The downturn had been largely predicted by economists, although it was slightly worse than the 0.2pc contraction forecast on average by analysts.

01:37 PM BST

American economy contracts as companies race to import goods

The US economy contracted in the first quarter as companies raced to import goods before the worst of Donald Trump’s trade tariffs took effect.

The contraction of 0.3pc is a sharp downturn from the 2.4pc growth experienced during the final three months of 2024, the data from the US Bureau of Economic Analysis showed.

“The decrease in real GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending,” it said.

01:30 PM BST

US economy shrinks as Trump launches tariff war

The US economy shrank during the first three months of the year, official figures show, as Donald Trump’s trade war hammered the world’s largest economy.

Gross domestic product slumped by 0.3pc during the first quarter after the US president began imposing tariffs on trading partners.

01:27 PM BST

Trump’s ‘truths’ should be a goldmine, but his media empire is bleeding cash

As the world’s stock markets descended into panic last month, Donald Trump was glued to his favourite app: Truth Social.

The US president posted more than 100 times on the social network he owns on March 10, even as fears grew that his tariffs would send the world spiralling towards a recession .

Almost all the “truths” he posted were links to articles either praising Trump or trashing his enemies. Among the blizzard of links was a seemingly unlikely promise: “We’re going to become so rich, you’re not gonna know where to spend all that money. I’m telling you – just watch!”

Truth Social was launched in 2022 as a rival to Twitter after Trump was banned from mainstream social networks after a mob of his supporters stormed the Capitol on Jan 6 2021. Initially, Truth Social struggled to stand apart amid a wave of Twitter clones that vied for the attention of Right-wing internet users disillusioned with Facebook and Twitter.

12:43 PM BST

Pound poised for best month in over a year

The pound remained was on track for its strongest month against the dollar since November 2023 after Donald Trump’s tariffs unleashed turmoil on financial markets.

Sterling was down 0.3pc versus the US currency at $.1339 but remained close to a three-year high ahead of data this afternoon on the US economy.

The pound was up 3.8pc against the dollar this month, and has even outperformed the euro, rising 1.7pc against the common currency in April.

12:34 PM BST

Aberdeen clients pull £5bn amid financial market turmoil

Aberdeen saw its assets shrink in the first three months of the year as clients withdrew more than £5bn amid volatile conditions in global financial markets.

The asset manager, which added vowels back to rebrand from Abrdn last month, revealed total assets under management of £500.1bn for first quarter.

It said this dropped from £511.4bn over the past three months, as it came under pressure from increased client outflow. It has sought to reduce costs with rounds of job cuts.

However, shares rose 0.6pc as Aberdeen highlighted improvement in its Interactive Investor platform business, which reported a net inflow of £1.6bn for the quarter as it benefited from market volatility driving trading activity.

Jason Windsor, chief executive of Aberdeen, said: “Our strategy is to become the UK’s leading wealth business and to reposition our investments business to areas of strength and market growth.

“So far this year, we have made good progress against these objectives, despite the current heightened levels of market uncertainty.”

12:10 PM BST

FTSE 100 edges higher ahead of US economic figures

The FTSE 100 was clinging on to its longest run of gains in nine years ahead of figures that will show how the US economy has faired so far under Donald Trump.

The UK’s blue-chip stock index was up 0.2pc, putting it on track for a 13th consecutive daily increase.

It is its longest positive streak since January 2017, although the index was still on track for a monthly decline of 1.3pc in the wake of President Trump’s tariff tirade.

The US will unveil its first quarter GDP figures this afternoon, which are expected to show a downturn.

Smith & Nephew was the best performer, rising by as much as 7.5pc after the healthcare group reported solid earnings in the first three months of the year.

GSK and Coca-Cola HBC were up 4.1pc and 2.5pc, respectively, after also reporting first quarter results.

However, Glencore sank as much as 7.1pc to the bottom of the index amid concerns that the trade war will impact demand from China, where figures indicated a sharp slowdown in export orders.

Fellow miners Antofagasta and Anglo American were also down about 4pc.

Neil Wilson, a strategist at Saxo UK, said: “Although we have some generally positive sentiment around trade deals – US commerce secretary Howard Lutnick saying one has been struck already – risk appetite is fragile and some weak China data overnight is perhaps holding back the bulls.”

11:47 AM BST

China ‘will tolerate downturn more than America’

Donald Trump’s tariff war has left him a risk from a “deepening loss of confidence” from the American public, according to Telegraph readers.

Here is a selection of views on the tariff war from our comments section below and you can join the debates here :

11:29 AM BST

Europe at ‘moment of opportunity’ in face of US tariffs, says BNP Paribas

Europe has arrived at a “moment of opportunity” as the world catches up to the US economy which faces a tariff-induced slowdown, according to BNP Paribas.

The French bank said most countries’ appetite for more international trade “appeared not just intact but boosted” following Donald Trump’s tariff onslaught as nations seek ways to make up lost trade with the world’s largest economy.

The eurozone economy grew twice as fast as expected in the first three months of the year, official data showed today, as companies raced to complete export orders before President Trump announced his “liberation day” levies in April.

BNP Paribas chief economist Isabelle Mateos Y Lago said Europe has the ability to counter the US tariff shock “and for once seems determined to use it without harmful delays”.

She said Europe “has already taken historical decisions to change the scale of its defense spending in a coordinated way” following the incoming German chancellor’s plan to loosen the fiscal rules of Europe’s largest economy.

She added: “All in all, while participants recognised the historic scale of the policy pivot initiated by the US, and saw an exceptionally wide range of potential outcomes, most felt they had agency to cope with the shock and land their own economies in a better place at the end.”

11:11 AM BST

Dimon backs Reeves’s ‘pro-growth agenda’

Rachel Reeves has been handed a boost from the boss of one of Wall Street’s biggest banks, who has said Britain’s economic reforms are making it a better place to invest.

Jamie Dimon, the chief executive of JP Morgan, said he backed the Chancellor’s “pro-growth agenda” days after she arrived back from a trip to Washington where she talked up the nation’s economic prospects at the IMF spring meetings.

“I’ve always been a believer in the UK’s inherent strengths as a place to do business and there’s much to like about the new government’s pro-growth agenda,” Dimon told the Financial Times.

“They have reinforced their commitments to an open economy, strengthening of infrastructure and the stability of markets — all of which is good for investor confidence.”

The comments come days after BlackRock chief executive Larry Fink said the world’s largest asset manager had been buying billions of pounds of UK assets it considered “undervalued”, and praised the government for tackling “some of the hard issues”.

10:39 AM BST

House prices fall as tariffs hit consumer confidence

House prices in Britain fell at the fastest pace since August 2023 during April, a survey showed, as the tariff uncertainty hit consumer confidence just as a rush to beat the rise in stamp duty rise came to an end.

Property values dropped unexpectedly by 0.6pc compared to March to an average of £270,752, according to the Nationwide house price index.

Nationwide’s chief economist Robert Gardner said the first monthly decline in prices in eight months “was to be expected, given the changes to stamp duty at the start of the month”.

He said: “Early indications suggest there was a significant jump in transactions in March, with buyers bringing forward their purchases to avoid additional tax obligations.

“The market is likely to remain a little soft in the coming months, following the pattern typically observed following the end of stamp duty holidays.”

The downturn in the market came as Donald Trump heightened consumer anxiety with his “liberation day” tariffs, which caused turmoil in financial markets.

Ashley Webb of Capital Economics said: “House prices are relatively well insulated from US tariffs effects.

“That’s because any drag on housing demand due to higher uncertainty caused by US tariffs would probably be offset by a fall in mortgage rates.

However, Elliott Jordan-Doak of Pantheon Macroeconomics said the ongoing trade war and “chronic US policy uncertainty complicate the path for house prices”.

He said: “We expect slower economic growth and higher unemployment as a result of higher trade frictions, which will keep a lid on housing demand.”

10:09 AM BST

Eurozone economy grows faster than expected

The eurozone economy grew faster than expected in the first three months of the year, official figures show, as Germany avoided a technical recession.

Gross domestic product expanded by 0.4pc in the first quarter, according to Eurostat, up from 0.2pc the previous quarter and double analyst estimates.

However, economists warned they still expect growth to slow sharply in the next six months.

Franziska Palmas of Capital Economics said the US tariffs introduced in April “will hit activity and any boost from German fiscal stimulus will mostly be felt next year”.

She expects Donald Trump’s trade war to deliver a 0.2pc hit to growth.

Germany’s economy grew by 0.2pc in the first quarter after a 0.2pc contraction at the end of 2024.

Carsten Brzeski of ING said: “While today’s GDP report is welcome news, it doesn’t take away the risk that the German economy will remain in an – admittedly small – recession for the third consecutive year, for the first time ever.

“As the incoming German government is taking shape and should start next week, fixing the economy should still be on top of the to-do list.”

09:45 AM BST

Taiwan economy surges as companies race to beat US tariffs

Taiwan’s export-driven economy accelerated faster than expected in the first quarter of the year, official data showed, as companies stocked up ahead of Donald Trump’s “liberation day” tariffs.

The island of 23m people is a powerhouse in the semiconductor industry, with nearly all of the world’s most advanced chips made there.

Soaring demand for AI-related chips in recent years has fuelled Taiwan’s trade surplus with the US – and put it in the cross-hairs of President Trump and his far-reaching tariffs.

Gross domestic product expanded 5.4 pc in the first quarter, the fastest pace in a year, the government’s statistics agency said in a statement, beating analyst estimates of 3.6pc and fourth-quarter growth of 2.9pc.

“Demand for AI and emerging technology applications remains strong, supply bottlenecks for high-end ICT products are gradually easing, and customers are front-loading inventory in response to US tariff measures,” the statement said.

Taiwan was hit with a 32pc levy on its shipments to the US on April 2 when Trump announced hefty tariffs against many trading partners.

The tolls were suspended for 90 days after trillions of dollars were wiped off world markets, but a 10pc blanket tariff remains in place.

Taiwan’s negotiating team has held talks with the Trump administration to reduce the levy.

Its trade surplus with the United States is the seventh highest of any country, reaching $73.9bn in 2024.

09:32 AM BST

GSK ‘well positioned’ to handle tariff upheaval

Drugmaker GSK said it is “well positioned” to cope with any financial impact from changes to US tariff rules.

The FTSE 100 giant revealed a rise in sales as weakness in its vaccine division was offset by growth in speciality medicines.

GSK, formerly GlaxoSmithKline, reported total sales grew by 4pc to £7.5bn for the first quarter of 2025, compared with a year earlier.

This came on the back of a boost from its speciality medicines division, where sales rose 17pc on the back of strong demand for oncology, respiratory and HIV treatments.

It helped to offset another decline in its vaccines arm, where sales dropped by 6pc to £2.1bn for the quarter.

Shares rose 3.7pc after the group said it is on track for turnover to increase by between 3pc and 5pc over the current year, in line with previous guidance.

It held financial guidance for the year despite uncertainty over US tariffs, with the Trump administration currently investigating whether to change tariff policy for the sector.

“The company is well positioned to respond to the potential financial impact of sector-specific tariffs, should they be implemented, with mitigation options identified in the supply chain and productivity initiatives,” GSK told shareholders on Wednesday.

“The company will continue to monitor and review developments related to this situation.”

09:14 AM BST

Barclays trading business boosted by Trump trade war

Barclays profits rose after it capitalised on the market volatility caused by Donald Trump’s presidency.

The British bank posted a 19pc increase in its pre-tax profits in the first quarter of 2025, compared to the same period last year.

Its profits were boosted by a 16pc rise in income from its investment banking division, to £3.9bn, on the back of a strong performance from its trading business.

Chief executive CS Venkatakrishnan, known as Venkat, said: “Our trading business did very well.”

The banking boss said Barclays’ recent investments in its trading business had strengthened its abilities to “navigate carefully through this current circumstance”.

The lender reported a 9pc increase in income from its stock trading business to £963m as it profited on the wild swing in markets since Trump entered office on January 5.

Barclays shares jumped as much as 4pc in early trading, having surged in value by 49pc over the last year.

The strong results come after its boss outlined plans to overhaul the British lender’s business in February 2024.

Venkat’s turnaround plan has seen the boss aim to slash Barclays’ costs by £2bn with a view to returning £10bn to shareholders by the end of 2026.

Barclays’ income was also boosted by its acquisition of Tesco Bank, which it completed in October last year.

08:54 AM BST

China hails ‘precious stability’ from EU ties

China hailed its ties with the European Union as adding “precious stability” to the global economy, as Beijing seeks closer relations with the bloc.

Foreign ministry spokesman Guo Jiakun said: “China and the EU complement each other’s strengths in economic and trade cooperation, creating mutual benefits and win-win outcomes.”

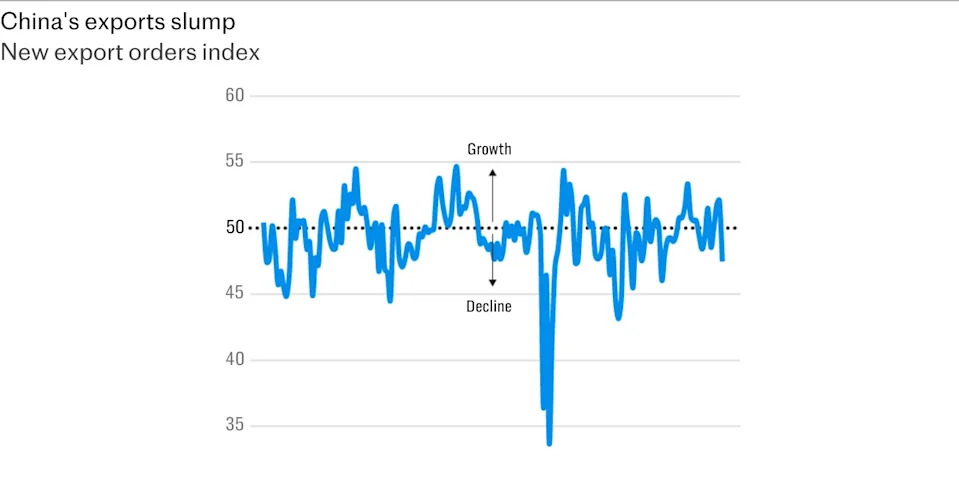

It comes as two closely watched business surveys showed export orders from China plunged to their lowest level since December 2022 during April.

08:50 AM BST

China exports plunge as Trump trade war hits

Chinese export orders have slumped in the wake of Donald Trump’s trade war with experts warning there is far worse to come.

New orders collapsed in April, according to two closely-watched business surveys. Both China’s official PMI and the Caixin index showed orders stood at their lowest since December 2022, when China finally abandoned its zero-Covid policy.

A gauge that measures new orders fell to 44.7 in the official index and 47.5 in the Caixin measure which is more weighted towards private businesses. This helped to drive a decline in overall manufacturing activity in April, the official index showed.

While activity remains well above the readings in 2020 when the world was largely locked down, economists warned that the slowdown in the world’s second largest economy was just beginning.

Duncan Wrigley, chief China economist, warned “it will get worse for China”, with the pain likely to last for “months or longer”.

He noted that the Caixin survey was conducted in the fortnight to April 22, with subsequent port data suggesting exports have collapsed since then.

Container bookings from China to the US are down by as much as 60pc, according to supply chain management company Flexport, while Los Angeles ports have seen a 10pc drop in activity, according to officials.

Mr Wrigley said: “Neither the US or China appears ready to make the necessary overtures to begin serious negotiations. More evidence of economic pain on both sides will probably be needed to get talks going, likely taking several months or longer.”

08:46 AM BST

Glencore falls as US tariffs yet to boost commodity trading

Glencore was the worst performer on the FTSE 100 as it said US tariffs had not yet presented a major opportunity for its commodity traders – although it added that they could benefit yet from disruptions to supply chains.

The mining giant said that so far most routes for materials were operating normally despite the turmoil in financial markets caused by President Trump’s trade war.

Chief executive Gary Nagle said: “Despite the ‘noise’, primary commodity trade routes to date have not been meaningfully disrupted.

“However, owing to the various proposed and currently being implemented tariffs across commodity supply chains, it is likely that some physical trade flow re-orientation and dislocation will manifest over the coming months, which may present opportunities for our marketing business.”

Shares were down 4.6pc as Glencore said it expects full-year profits from marketing business – where it sources commodities and products from our global supplier base for customers – to be around the middle of its long-term guidance range of $2.2bn to $3.2bn (£1.6bn to £2.4bn).

The commodity trading business has seen earnings decline from records set a couple of years ago in the wake of the turmoil caused by Vladimir Putin’s decision to invade Ukraine.

The unit earned $3.2bn last year, down from $3.5bn in 2023.

08:20 AM BST

TotalEnergies profits hit by slump in oil price

TotalEnergies profits declined in the first three months of the year amid a global slide in crude oil prices as a result of Donald Trump’s tariff onslaught.

The French group said that its first-quarter net profit came in at $3.9bn (£2.9bn), a third lower than the same period in 2024.

However, the company noted that result was broadly in line with the final quarter of last year.

TotalEnergies boosted crude oil production by 2pc from the first quarter of 2024, but that was not enough to compensate for 9pc drop in the price of Brent.

Global crude prices have slid in recent months as stiff tariffs introduced by Donald Trump’s administration have sparked concerns about a slowdown in the global economy that could impact demand.

Gas production climbed by 6pc, with prices rising by nearly 30pc. The gain for liquefied natural gas (LNG) was only 4pc, however.

TotalEnergies boosted electricity production by 18pc.

The company raised its first quarter interim dividend by 7.6pc despite what chief executive Patrick Pouyanne described as a “softening price environment with Brent below $70 per barrel since the beginning of April and an uncertain geopolitical and macroeconomic context”.

It will proceed with up to $2bn in share buybacks during the current quarter.

08:04 AM BST

UK markets rise as Trump eases car tariffs

The FTSE 100 rose at the open after Donald Trump scaled back his tariffs against the car industry.

The UK’s flagship stock index rose by 0.2pc to 8,479.29 while the mid-cap FTSE 250 gained 0.4pc to 19,891.37.

08:02 AM BST

Barclays sets aside extra £74m for bad debts caused by tariff turmoil

Barclays set aside more cash for bad debts due to worries over the US economy and a mounting global trade war.

The UK banking giant increased provisions for loans that it expects to turn sour to £643m, up from £513m a year ago.

This was largely driven by £74m put by for “elevated US macroeconomic uncertainty”.

The bank reported a 19pc rise in pre-tax profits to £2.7bn for the three months to March 31.

The group said it “continues to monitor the heightened uncertainty in the near-term macroeconomic outlook, especially in the US”.

Barclays has an exposure to the mounting trade war sparked by President Donald Trump through its sizeable operations in America.

But group chief executive CS Venkatakrishnan, known within the bank as Venkat, cheered a robust first three months of the year, confirming the lender is on track for 2025 and 2026 guidance.

He said: “I am very pleased with our performance in the first quarter, which represents another strong quarter of execution.”

While it kept its outlook unchanged, the group increased its guidance for net interest income - a key measure for retail banks - to more than £12.5bn from around £12.2bn previously, with some £7.6bn now expected from the UK arm.

The results show it also delivered around £150m in cost savings in the first quarter as part of its ongoing overhaul.

07:53 AM BST

UBS warns of ‘unpredictable’ outlook amid tariffs

Swiss banking giant UBS revealed a better-than-expected profit for the first quarter but warned of a “particularly unpredictable” outlook for the economy due to US tariffs.

UBS, which is still in the process of fully absorbing rival Credit Suisse, said its profit after tax reached $1.7bn (£1.3bn) in the first three months of the year.

It was a 4pc drop from the same period a year ago, but better than the $1.3bn forecast by analysts.

Its revenue fell 1pc to $12.6bn but it was much higher than the $11.38 billion expected by AWP analysts.

Its wealth management unit posted revenue growth of five percent to $6.4bn while investment banking revenue rose 16pc to $3.2bn amid market volatility.

UBS was cautious in its outlook for the year, noting that Donald Trump’s tariffs blitz had caused major volatility in the markets.

“With a wide range of possible outcomes, the economic path forward is particularly unpredictable,” the bank said in its earnings statement.

“The prospect of higher tariffs on global trade presents a material risk to global growth and inflation, clouding the interest rate outlook,” it said.

“Prolonged uncertainty would affect sentiment and cause businesses and investors to delay important decisions on strategy, capital allocation and investments.”

07:37 AM BST

Mercedes-Benz pulls profit guidance amid tariff turmoil

Mercedes-Benz has withdrawn its profit outlook for this year due to the uncertainty caused by the global trade war.

The German manufacturer said the volatility sparked by tariffs “is too high to reliably assess the business development for the remainder of the year”.

It said: “Assuming all of the currently implemented and the announced tariffs become effective and remain in place until the end of the year, material impacts are expected.”

The company said first quarter net profit tumbled nearly 43pc in the firs three months of the year to €1.7bn (£1.5bn) as it struggled with weak demand in China.

Underlying earnings also fell sharply to reach €2.3bn, which was about 15pc below analyst expectations.

07:21 AM BST

Aston Martin slashes US imports amid tariff uncertainty

Aston Martin said it was limiting imports to the US and allowing dealerships to run down stocks amid the uncertainty caused by Donald Trump’s tariffs.

The luxury car maker’s chief executive Adrian Hallmark said he remained “vigilant” to the evolving US duties faced by the car industry under the Trump administration.

The decision to limit imports comes after the US president imposed 25pc tariffs on overseas cars and parts, although he announced on Tuesday that he would scale back some duties after pressure from the industry.

Aston Martin revealed revenues sank to £233.9m in the first three months of the year, down 13pc on the same period in 2024 and below analyst estimates.

Underlying losses deepened to £64.5m, although it said its performance was in line with its guidance.

Mr Hallmark said: “We are carefully monitoring the evolving US tariff situation and are currently limiting imports to the US while leveraging the stock held by our US dealers.

“We remain vigilant in monitoring events and will respond to changes in the operating environment as they materialise.”

07:07 AM BST

Advertisers scale back growth forecasts as tariffs hit

The advertising industry has scaled back its predictions for growth this year in an early sign of how Donald Trump’s tariff chaos will impact the British economy.

Ad spend is forecast to hit £45.2bn in 2025, according to figures from the Advertising Association and Warc. While this marks a 6.3pc increase on last year, it is a 0.6 percentage point downgrade on previous forecasts published in January.

Industry bosses said the downgrade reflected a tougher trading backdrop after the US President’s volatile approach to trade policy sparked turmoil in global markets, as well as the continued impact of Labour’s tax rises.

James McDonald at Warc said: “Though we expect investment to grow in the coming years, we are cognisant that confidence in the UK’s advertising market remains fragile, burdened by sustained economic stagnation and recently introduced business taxes outlined in the Autumn statement.

“The introduction of new trade tariffs by the Trump administration adds further complexity, particularly for sectors with high exposure to international supply chains.”

UK advertising behemoth WPP last week said it had yet to see a “significant change” in spending by clients as a result of Mr Trump’s tariffs.

However, chief executive Mark Read warned he the uncertainty would hit many of the company’s clients, particularly those in sectors such as automotive, and could spark a wider economic downturn that would hit advertising spending.

Advertising is often viewed as a bellwether for the wider health of the economy, with marketing budgets often the first to face huts in straitened times.

However, ad bosses dismissed this approach as “short-termism”. Stephen Woodford, chief executive of the Advertising Association, said: “It’s important to remember once again that advertising supports competition and promotes innovation, and helps to create jobs across the UK, so a healthy advertising sector is integral to a healthy economy.”

It comes after UK advertising spend jumped by more than 10pc to £42.6bn in 2024, with £4 in every £5 of ad budgets now spent online.

The TV industry also enjoyed its first year of growth since 2021 as brands rushed to advertise on new ad-funded tiers on Netflix and Disney+, as well on the streaming services of traditional broadcasters such as ITV and Channel 4.

07:06 AM BST

Trump weakens car tariffs after backlash

Donald Trump has watered down his tariffs on the car industry after manufacturers warned of a sharp rise in prices for US consumers.

In an executive order signed during a visit to the manufacturing heartland of Michigan last night, the President scaled back some of the steepest levies and offered credits to companies that make their vehicles in the US.

The climbdown, which came on the eve of Mr Trump’s 100th day in office and just before a fresh set of 25pc tariffs was due to kick in on imported automotive parts, followed an outcry from carmakers who warned of higher prices and a significant hit to sales.

Mr Trump told reporters the changes would offer a “little relief” as companies invest in more US production. He said: “We just wanted to help them ... if they can’t get parts, we didn’t want to penalise them.”

The move means that car manufacturers that are subject to an existing 25pc tariff on imported cars will not be required to pay other levies, such as those on steel and aluminium.

Companies will also be entitled to credits of up to 15pc of the value of vehicles assembled domestically, which could be applied against the cost of imported parts.

Scott Bessent, the US Treasury Secretary, yesterday said the President was “committed to bringing back auto production to the US”.

Yet the about-turn underscores the uncertainty unleashed by Mr Trump’s erratic trade policy, especially on the key automotive industry. Sales have spiked in recent weeks as customers rushed to purchase vehicles before higher prices came into effect.

GM, the largest car manufacturer in the US, yesterday made the unusual move of pulling its annual forecasts, saying it needed to wait for more clarity over tariffs.

Michigan is home to the so-called “Detroit Three” of GM, Ford and Stellantis. Despite the upheaval, all three car manufacturers welcomed Mr Trump’s decision to soften the tariffs.

06:46 AM BST

Good morning

Thanks for joining us. Donald Trump has scaled back his tariffs on the car industry after a backlash from manufacturers who warned it would put up prices for motorists.

The US president said he would offer “a little relief” which will mean carmakers paying the 25pc tariff on imports of parts will not be subject to other levies.

5 things to start your day

Trump rages at Bezos in heated tariffs phone call | Amazon races to calm the waters after White House accuses retailer of ‘hostile and political act’

Danish shoppers boycott Coca-Cola over Trump | Sales slump in Scandinavian nation following US president’s threats to annex Greenland

Buy our cancer drugs or jobs will go overseas, AstraZeneca warns | Sir Pascal Soriot fires warning at UK amid frustration over blocked breast cancer treatment

US is a ‘small, stranded boat’, says China in propaganda video | Beijing’s foreign affairs ministry mocks ‘isolated’ America on social media

Men are to blame for ‘motherhood penalty’, says Mumsnet founder | Justine Roberts says men need to be shamed into doing their fair share of domestic work

What happened overnight

Shares were mixed in Asia after US stocks rose again as companies reported stronger-than-expected profits.

Tokyo’s Nikkei 225 index edged 0.3pc higher to 35,942.90.

Japanese carmakers’ shares fell even after Trump signed an order relaxing some US tariffs on imports of cars and parts.

In Hong Kong, the Hang Seng rose 0.2pc to 22,044.84, while the Shanghai Composite index slipped 0.1pc to 3,282.96.

South Korea’s Kospi dropped 0.6pc to 2,550.05, while the S&P/ASX 200 in Australia picked up 0.4pc to 8,100.40.

Taiwan’s Taiex was little changed at 20,235.03.

On Tuesday, US stocks rose again. The S&P 500 climbed 0.6pc to 5,560.83 as its winning streak extended to a sixth day. The Dow Jones Industrial Average added 0.7pc to 40,527.62. The Nasdaq Composite rose 0.5pc to 17,461.32.