Here's the U.S. president's progress on campaign promises and his effect on key economic issues to date

Robinhood (HOOD) stock slipped after the company's first quarter adjusted EBITDA came in below analyst expectations, though the company still posted 50% revenue growth. Devin Ryan, Citizens director of financial technology research, joins Market Domination Overtime to explain why he sees this as an in-line quarter. To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime here.

Palantir (PLTR) and Netflix (NFLX) “are the true leaders” of the stock market at this point, Larry Tentarelli, the Chief Technical Strategist of the Blue Chip Daily Trend Report said on the Schwab Network recently. Meanwhile, Tentarelli noted that “Tesla (TSLA), whose shares he recently bought,, is “showing some promise” from a technical standpoint, while […]

Microsoft (MSFT) delivered earnings and revenue surprises of 8.13% and 2.46%, respectively, for the quarter ended March 2025. Do the numbers hold clues to what lies ahead for the stock?

Qualcomm (QCOM) delivered earnings and revenue surprises of 0.71% and 1.55%, respectively, for the quarter ended March 2025. Do the numbers hold clues to what lies ahead for the stock?

Meta Platforms (META) delivered earnings and revenue surprises of 23.18% and 2.61%, respectively, for the quarter ended March 2025. Do the numbers hold clues to what lies ahead for the stock?

Confluent (CFLT) delivered earnings and revenue surprises of 14.29% and 2.86%, respectively, for the quarter ended March 2025. Do the numbers hold clues to what lies ahead for the stock?

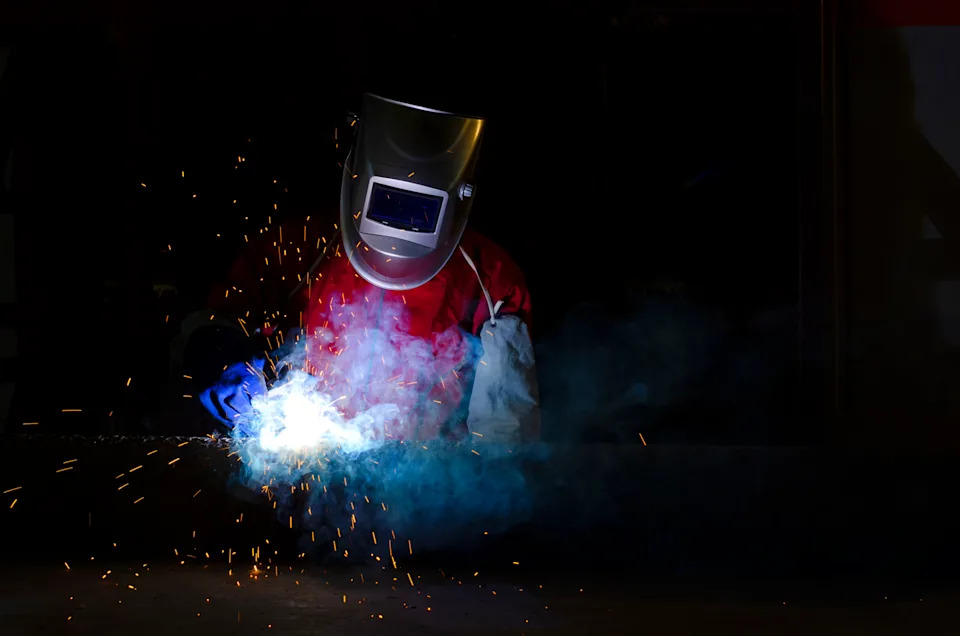

The company's first-quarter profitability left investors wanting. Lincoln Electric (NASDAQ: LECO) investors were hoping Wednesday that their company's first quarterly earnings report of 2025 wouldn't be indicative of how the rest of the year would go. The welding-products maker missed on the consensus analyst profitability estimate, and the market punished it by sending its stock to a more than 4% loss in price.

If investors wanted a reminder of the impact tariffs and trade wars have on markets, they got it on Wednesday as figures showed that U.S. GDP shrank in the first quarter, pushing Wall Street sharply lower before a powerful late rally ended an incredibly turbulent month on a positive note. Wednesday marked U.S. President Donald Trump's first 100 days in office, also a tumultuous period, by any measure. Stocks set for worst 100 day start since Nixon as Trumpinjects semi-permanent uncertainty 3.

Chief Executive Cristiano Amon said Qualcomm is navigating the current macroeconomic and trade environment and remains “focused on the critical factors we can control.”