Upwork and PACCAR have been highlighted as Zacks Bull and Bear of the Day.

LONDON/SHANGHAI/NEW YORK (Reuters) -A truce in the U.S.-China trade war set off a relief rally in stocks on Monday and propelled the dollar higher, but investors fear further negotiations could prove a long slog, as risks of a global economic slowdown persist. After two days of talks with Chinese officials in Geneva, U.S. Treasury Secretary Scott Bessent said the two sides agreed to a 90-day pause under which tariffs would fall by over 100 percentage points. The outcome exceeded the hopes of many investors ahead of the talks.

NRG's first-quarter 2025 earnings and revenues increase year over year. Adjusted EBITDA also increases during the same period.

Investors shunned safe haven assets like Treasuries as economic optimism from the walk back on tariffs have sent them rushing to buy riskier assets. The 10-year Treasury yield jumped to 4.448% from 4.

Due to celebrate its 40th anniversary in 2026, Acura faces challenges but also has a big opportunity which few are seeing.

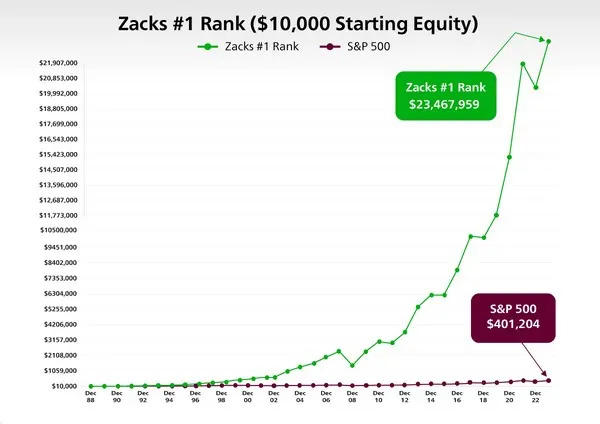

Our time-tested methodologies were at work to help investors navigate the market well last week. Here are some of our key performance data from the past three months.

You can catch Opening Bid on Apple Podcasts, Spotify, YouTube, or wherever you get your podcasts. The bulls are back on Wall Street, with good reason. The US and China have agreed to ratchet down the tariff war for 90 days as each economy begins to feel the pressure of bruising penalties. After a weekend of meetings in Switzerland, the US will take reciprocal tariffs on China down to 10% from 125%. A separate tariff imposed by President Trump over what he says is China’s role in the fentanyl trade will stay intact. China will cut its retaliatory tariffs on US goods to 10% from 125%. Stocks soared on the news, the US dollar caught a strong bid, and defensive plays such as gold sold off. Investors will now be looking for two things to keep the bullish vibes going: first, that the two economic superpowers signal there is an opportunity to take tariffs down even further after the 90-day pause; and second, that the tariffs aren’t hammering the US economy. Yahoo Finance Executive Editor Brian Sozzi spoke with eToro global markets analyst Lale Akoner on Opening Bid for perspective on whether stocks will be back for the rest of the year or if this is just a headfake. Akoner also discusses top picks in what is now a significantly changed backdrop for investors. For full episodes of Opening Bid, listen on your favorite podcast platform or watch on our website. Yahoo Finance's Opening Bid is produced by Langston Sessoms

US stocks are set to open higher later on Monday, while Europe’s major markets are all up in trading

The Trade Desk stock tumbled earlier this year, but its first-quarter results sent the stock sharply higher. For investors that still have many years before retirement, growth stocks are one of the most efficient ways to increase their net worth.

CytomX Therapeutics (CTMX) delivered earnings and revenue surprises of 50% and 43.36%, respectively, for the quarter ended March 2025. Do the numbers hold clues to what lies ahead for the stock?