Investors jumped on shares of Coinbase Global after the Monday night news that the crypto exchange will join the S&P 500 next week.

Advanced Micro Devices ( NASDAQ:AMD ) First Quarter 2025 Results Key Financial Results Revenue: US$7.44b (up 36% from...

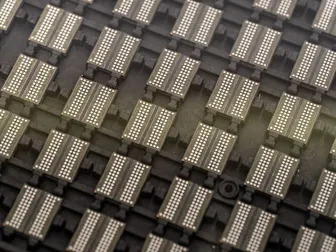

Shares of leading designer of graphics chips Nvidia (NASDAQ:NVDA) jumped 6% in the afternoon session after the company said it would sell more than 18,000 of its AI chips (GB300 Blackwell chips) to Saudi Arabian company Humain to be used in a 500 megawatt data-center project. The agreement also includes further expansion with "several hundred thousand" additional chips potentially planned for delivery within five years.

Shares of server solutions provider Super Micro (NASDAQ:SMCI) jumped 15.8% in the afternoon session after Raymond James analysts initiated coverage of the stock with a Buy rating and a price target of $41. The analysts called out SMCI's leadership in "AI-optimized infrastructure," noting that artificial-intelligence platforms represented approximately 70% of the company's sales.

Shares of data-mining and analytics company Palantir (NYSE:PLTR) jumped 8.9% in the afternoon session after Bank of America analyst Perez Mora raised the stock's price target to $150 while maintaining a Buy rating.

As CEO for more than a decade, Stephen Hemsley built up UnitedHealth Group now a $400 billion healthcare behemoth. With his return to the top job, the company will learn whether his playbook still works. Hemsley, 72, is back in the chief executive’s chair after seven years as chairman, and UnitedHealth is in a more vulnerable position than it has been since he started his first CEO stint in 2006, in the shadow of a stock-options-backdating scandal that helped lead to the ouster of his predecessor.

While the equity market (^DJI, ^IXIC, ^GSPC) and Big Tech stocks react to the latest US-China tariff news and April's Consumer Price Index (CPI) data, this strategist has his eye on one Magnificent Seven stock in particular. Catalysts anchor Madison Mills is joined by guest host and Prairie Operating Co.'s Lou Basenese discusses why Alphabet (GOOG, GOOGL) is most likely to have a "breakout solo career" from the rest of the Mag Seven pack, which he compares to a "boy band that's breaking up." To watch more expert insights and analysis on the latest market action, check out more Catalysts here.

In a geopolitical chess game with billions at stake, Saudi Arabia, the U.S. and Nvidia all have something to gain.

(Bloomberg) -- The Trump administration plans to overhaul regulations on the export of semiconductors used in artificial intelligence, tossing out a Biden-era approach that had drawn strenuous objections from US allies and companies including Nvidia Corp. and Oracle Corp.Most Read from BloombergAs Coastline Erodes, One California City Considers ‘Retreat Now’A New Central Park Amenity, Tailored to Its East Harlem NeighborsWhat’s Behind the Rise in Serious Injuries on New York City’s Streets?Lawsu

In true UnitedHealth fashion, the big health insurance stock was denying the Dow of a daily gain on Tuesday. The Dow was down 160 points, or 0.4%, but UnitedHealth stock was shaving 382 points off the index on its own with a nearly 17% drop. UnitedHealth is regularly a thorn in the Dow’s side due to the index’s antiquated weighting by stock price rather than market cap.